Trump’s Tariffs, Big Tech Earnings, and Jobs Report: Key Market Events This Week

Stocks React to Trump’s Tariffs Amid Strong Start to 2025

Markets experienced volatility last week as investors reacted to shifting economic policies and earnings reports. Stocks initially recovered from a sell-off fueled by DeepSeek concerns but faced renewed pressure on Friday as President Donald Trump moved forward with his latest tariff strategy.

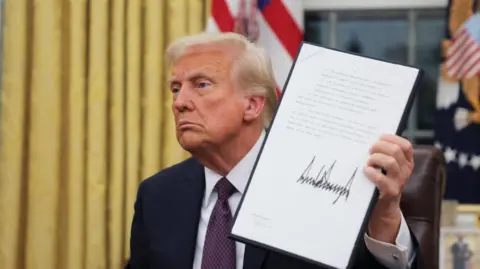

On Saturday, Trump announced tariffs targeting Canada, Mexico, and China, citing issues related to fentanyl trafficking and illegal migration. The policy imposes a 25% tariff on imports from Canada and Mexico and a 10% tariff on Chinese goods, set to take full effect by Tuesday, February 4. Investors will be closely monitoring how these trade restrictions impact supply chains, corporate earnings, and overall market sentiment.

Market Performance: A Strong January Despite Uncertainty

Despite concerns over trade policy, the stock market had a positive start to 2025. In January, the S&P 500 (^GSPC) climbed 2.7%, the Nasdaq Composite (^IXIC) gained 1.6%, and the Dow Jones Industrial Average (^DJI) outperformed with a 4.7% increase. As markets digest the new tariffs, traders and analysts will be watching for potential fluctuations in sectors most exposed to global trade.

What’s Ahead: Key Events to Watch This Week

The upcoming week is packed with major economic updates and earnings reports that could shape market direction. Investors will be focusing on three primary areas:

1. Trump’s Tariff Policy and Market Reaction

Analysts will evaluate how the new trade restrictions impact various industries, particularly manufacturing, retail, and technology.

Companies reliant on international supply chains may issue updated guidance in response to the tariffs.

2. January Jobs Report and Economic Indicators

The January Nonfarm Payrolls report, scheduled for release on Friday, will provide insight into labor market strength.

Additionally, investors will review data on job openings, manufacturing activity, and services sector performance for clues about economic momentum.

3. Earnings Reports from Big Tech and Major Corporations

A wave of corporate earnings will dominate headlines, with 131 S&P 500 companies set to report.

Notable releases include:

Amazon (AMZN) – E-commerce and cloud computing trends remain key focuses.

Alphabet (GOOGL, GOOG) – Investors will assess advertising revenue and AI investments.

Chipotle (CMG) – Consumer spending trends and menu innovations will be in the spotlight.

Eli Lilly (LLY) – Pharmaceutical earnings could indicate broader healthcare sector performance.

Market Outlook: Volatility and Key Economic Trends

With the stock market coming off a strong January, this week’s developments will be critical in determining whether bullish momentum continues. Traders will closely analyze how Trump’s tariffs influence inflation, corporate profitability, and global trade relationships. Additionally, employment data and earnings reports will provide fresh insight into economic health, shaping expectations for Federal Reserve policy and future market performance.

As investors navigate this high-impact week, all eyes will be on economic data and company earnings, with the potential for significant market moves ahead.

Source : Swifteradio.com