Stocks and Dollar Climb as Markets Eye Inflation Data and Powell Speech

U.S. equity futures made modest gains, with the S&P 500 and Nasdaq 100 each edging up around 0.1%, as investors await critical inflation data and remarks from Federal Reserve Chair Jerome Powell, which could shape expectations for a potential interest rate cut in December. Treasury yields dipped slightly after recent consumer inflation figures kept hopes alive for a rate reduction next month, though the dollar index held firm near two-year highs, continuing its rally amid market speculation.

This cautious optimism reflects an attempt by investors to balance easing inflation and potential rate cuts with potential economic policy shifts under President-elect Donald Trump, who could introduce aggressive tax and trade policies that may stoke inflation in the coming year. With Republicans sweeping the recent elections, Trump now faces fewer restrictions on his policy moves, which could have substantial market implications.

Amelie Derambure, a senior multi-asset portfolio manager at Amundi, noted, “There’s some selective optimism around Trump’s policies being growth-friendly and supportive of inflation, albeit not at extreme levels. Market pricing reflects a ‘soft Trump’ approach that emphasizes deregulation and economic stimulus.”

Dollar Strength on the Rise, Weighing on Global Assets

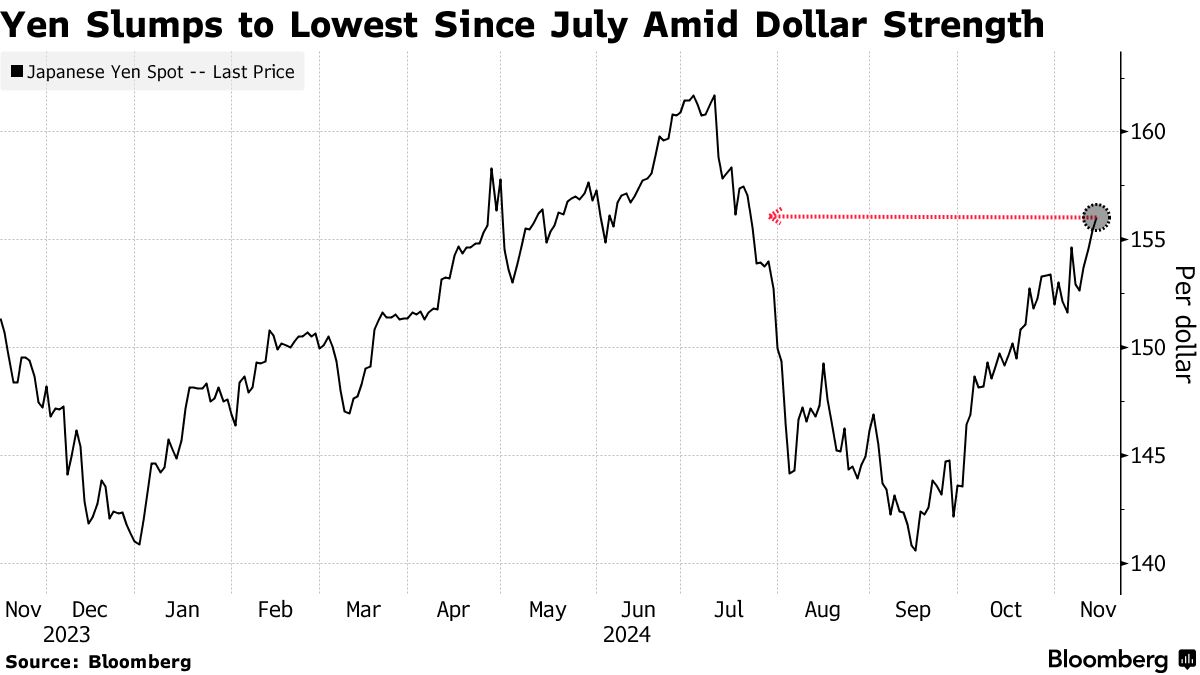

The dollar’s surge, which has pushed it up over 2% this month, is adding pressure across various asset classes. Gold prices have been pushed near two-month lows, while the yen has weakened to levels not seen since July. The euro also saw a 0.5% dip, marking its lowest point in over a year, as the dollar’s strength continues to overshadow other currencies, pushing MSCI’s emerging market currency index down for a fifth consecutive day.

Some analysts are cautious about how long the rate cut momentum can continue, especially given Trump’s potential influence on future Fed policy. Analysts from Brown Brothers Harriman highlighted that Trump’s probable ability to drive his agenda could limit future rate cuts, recommending investors position themselves to capitalize on dollar strength.

“The market’s pricing on the Fed has already adjusted to reflect this dollar strength, so investors should lean into it,” they advised.

Market Outlook: Balancing Inflation Hopes and Economic Uncertainty

With Jerome Powell’s speech anticipated by the markets, any hints about rate policy or inflationary pressures could influence the direction of equities, currencies, and commodities. The market currently reflects a cautious optimism, expecting policies that could stimulate economic growth without triggering runaway inflation.

Bitcoin also remains steady near its recent highs, trading around $91,000 as investor interest in alternative assets continues amid the broader financial market’s focus on U.S. policy shifts and monetary dynamics.

As markets await further clarity, the dollar’s robust position and potential for policy-driven growth highlight the tension between easing inflation expectations and a possibly assertive economic agenda under the new administration.

Source : Swifteradio.com