Oil Prices Decline Amid Concerns Over China’s Economic Outlook and Global Demand

Oil prices dropped for a second consecutive day, weighed down by a muted economic outlook in China, the world’s top crude importer, and concerns over global demand heading into 2025. Brent crude fell below $74 a barrel, after a more than 2% decline on Friday, while West Texas Intermediate (WTI) hovered near $70. Investors are closely watching for signs of stability amid a mixed global economic landscape, as oil markets enter a potentially volatile period.

China’s Economic Slowdown Dampens Oil Demand

China’s economic health has been a major influence on oil markets in recent months, as signs of an ongoing slowdown continue to impact demand. Over the weekend, data revealed sluggish consumer inflation in China for October, coupled with further declines in factory-gate prices. The Chinese government recently introduced a debt-swap program aimed at easing economic strain, but stopped short of any aggressive stimulus measures. This cautious approach disappointed investors who had hoped for a stronger policy response to stimulate the economy and boost industrial activity, which is typically energy-intensive.

“China’s economic data remains a soft point in the global oil demand story,” commented Chris Weston, head of research at Pepperstone Group. “Without significant stimulus, the outlook for demand from the world’s largest importer looks weak.”

The current conditions have cast a shadow over the crude market, as weaker-than-expected demand from China is likely to continue influencing global prices. The lack of clear economic recovery signals has kept traders on edge and contributed to volatility in oil prices.

Geopolitical Tensions and U.S. Election Concerns

In addition to the economic outlook in China, oil traders are watching geopolitical developments closely, particularly the potential effects of Donald Trump’s re-election on U.S. economic policy and tensions in the Middle East. Speculation around Trump’s policies on energy and trade, as well as the implications of heightened tensions between Israel and Iran, are factors that could contribute to supply instability and influence market sentiment.

While analysts acknowledge that the U.S. election could affect long-term growth expectations, many do not expect significant immediate impacts on oil markets this week. “Granted, we have U.S. election risk that could impact growth expectations, but we’re not expecting that battle to bite and impact this week,” Weston added.

Surplus Concerns and Market Fundamentals

Looking toward 2025, concerns of a surplus in the global oil market are adding to bearish sentiment. Market participants are preparing for a series of influential outlook reports this week that could set the tone for the remainder of the year. On Tuesday, the Organization of the Petroleum Exporting Countries (OPEC) is set to release its latest forecast, followed by the U.S. Energy Information Administration’s (EIA) short-term outlook on Wednesday, and the International Energy Agency’s (IEA) assessment on Thursday.

In its last report, OPEC downgraded its global demand forecast, a move that signaled potential challenges in balancing supply and demand in the near future. With OPEC’s upcoming outlook, investors are keen to see whether the organization maintains its cautious stance or adjusts its production strategy to support prices.

The EIA’s and IEA’s reports are also expected to offer insight into anticipated supply and demand patterns. Each of these reports will provide critical guidance for oil traders attempting to navigate a complex market landscape.

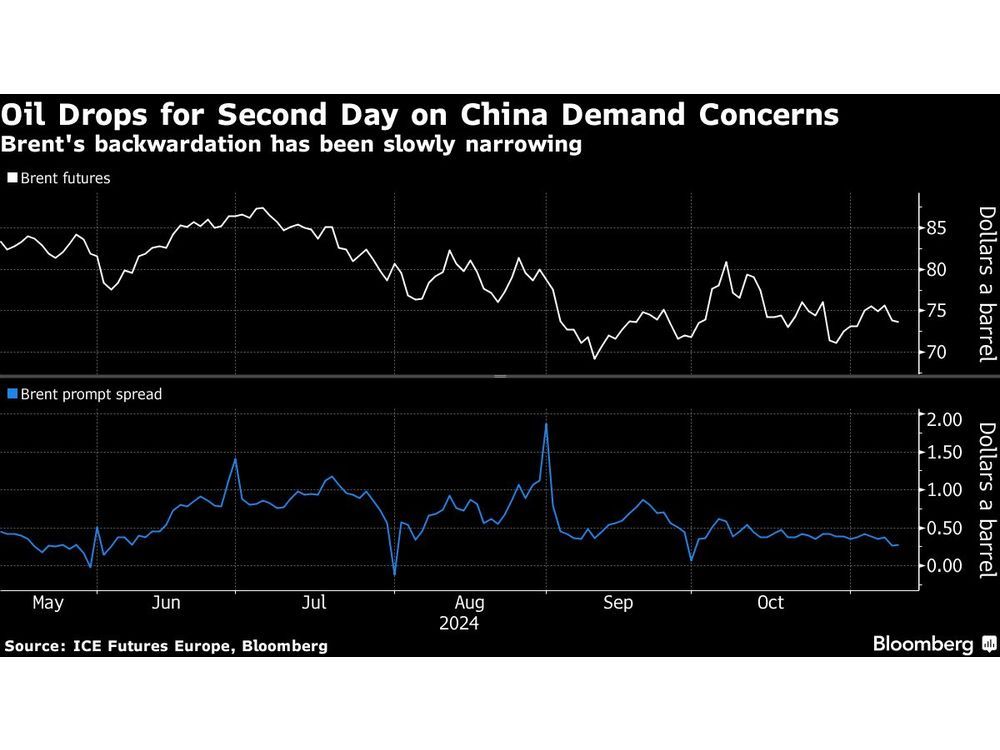

Narrowing Timespreads Signal Weaker Physical Market

Another key indicator of the physical market’s weakening is the narrowing of Brent’s timespreads. The prompt spread, or the price difference between Brent’s two nearest contracts, reflects the market’s perception of immediate supply and demand. While still in backwardation — a structure where near-term prices are higher than those for later delivery, indicating stronger demand — the spread has been narrowing. The spread was recently at 27 cents per barrel in backwardation, down from 44 cents a month ago, suggesting that physical demand is beginning to wane.

This narrowing timespread hints that the physical crude market is feeling pressure from broader macroeconomic uncertainties and could reflect softening demand in major markets like China.

Looking Ahead: Will Prices Stabilize?

As market participants await clarity from this week’s outlook reports, the oil market finds itself at a crossroads. Despite recent declines, Brent and WTI prices may stabilize around current levels if upcoming data supports a balanced demand-supply outlook. However, the prospect of a surplus in 2025 and lingering concerns over China’s economic performance may keep a lid on any potential price rebound.

Weston summed up the market sentiment, stating that “the crude market has hit a fair value and feels incredibly comfortable at the $70 level.” Nevertheless, traders remain alert to any factors that could shift the market trajectory, particularly as winter approaches and demand dynamics change in major economies.

In summary, oil prices are under pressure as China’s muted economic outlook and concerns about a potential global surplus weigh on the market. The geopolitical landscape and upcoming policy outlooks will be pivotal in determining the market’s direction in the coming weeks. With a slate of key data expected from OPEC, EIA, and IEA, traders are bracing for volatility as they assess demand trends and navigate ongoing uncertainties.

Source : Swifteradio.com